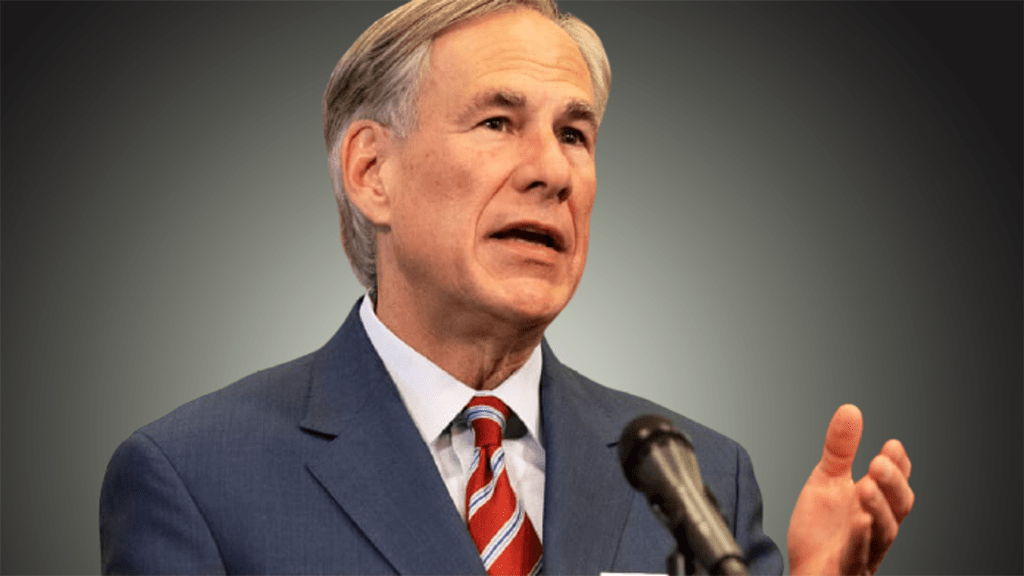

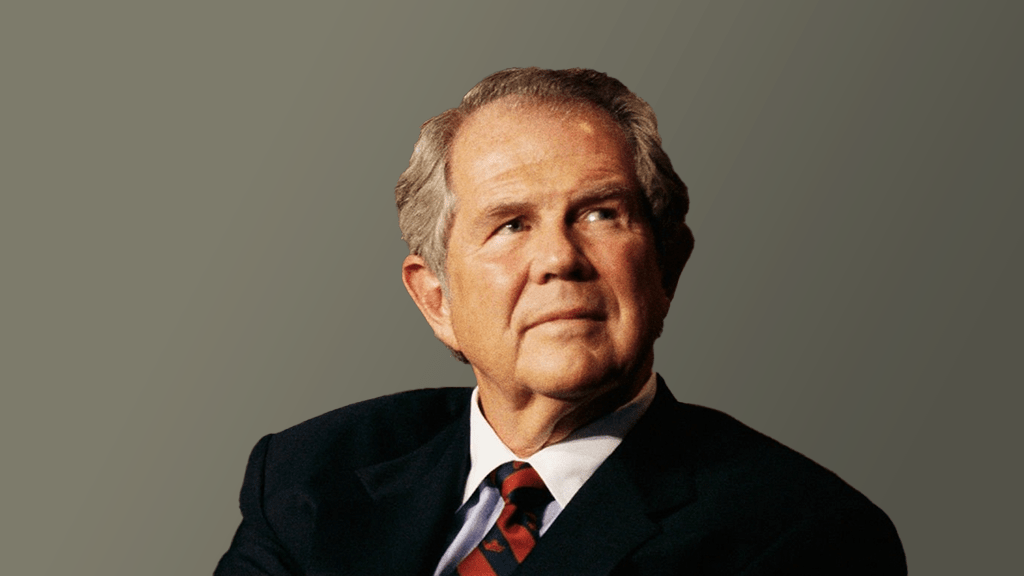

Pat Robertson, Broadcaster Who Shaped GOP Politics with Religion, Passes Away

June 8, 2023: Pat Robertson, the renowned religious broadcaster who transformed a small Virginia station into the influential Christian Broadcasting Network, played a role in Republican Party politics, and significantly impacted American religious and political landscapes through his Christian Coalition, has died at the age of 93.

Robertson’s broadcasting network announced his death on Thursday without providing a cause.

In addition to his broadcasting endeavors, Robertson established Regent University, an evangelical Christian institution in Virginia Beach. He also founded the American Center for Law and Justice, an organization dedicated to defending the First Amendment rights of religious individuals, and Operation Blessing, an international humanitarian group.

For over fifty years, Robertson was a familiar face in American households, primarily known for his television show, the “700 Club.” In later years, he gained attention for his televised declarations of God’s judgment, attributing natural disasters to various factors such as homosexuality and the teaching of evolution.

His influence and financial support increased as he solicited donations, and he amassed a large following when he transitioned into politics by running for the GOP presidential nomination in 1988.

Robertson pioneered the strategy of appealing to evangelical Christian churches in Iowa, which has since become customary for Republican candidates. In the Iowa caucuses, he finished second, surpassing Vice President George H.W. Bush.

One of Robertson’s most significant moves was his insistence that three million followers nationwide sign petitions before he decided to run for president. This tactic allowed him to gather a devoted following.

Jeffrey K. Hadden, a sociologist, and Robertson’s biographer, described this move as one of the candidate’s most ingenious strategies. Robertson asked people to pledge their support, pray for him, and provide financial contributions, which solidified his campaign.

Ultimately, Robertson endorsed George H.W. Bush, who won the presidency. The pursuit of Iowa’s evangelical voters has become a tradition for Republican presidential hopefuls, including those vying for the 2024 election.

In 1989, Robertson established the Christian Coalition in Chesapeake, Virginia, stating that it would further his campaign’s principles. The coalition became a powerful political force in the 1990s, effectively mobilizing conservative voters through grassroots activities.

By the time Robertson resigned as the coalition’s president in 2001 to focus on ministry work, his impact on religion and politics in the United States had been immense, according to John C. Green, a retired political science professor at The University of Akron.

Robertson’s influence in religious broadcasting inspired many others to follow a similar path, firmly establishing the alliance between conservative Christians and the Republican Party, as noted by Green in 2021.

Born Marion Gordon “Pat” Robertson on March 22, 1930, in Lexington, Virginia, to Absalom Willis Robertson and Gladys Churchill Robertson, he came from a politically involved family. His father served as a U.S. Representative and U.S. Senator from Virginia for 36 years.

After graduating from Washington and Lee University, Robertson served as an assistant adjutant in the 1st Marine Division in Korea.

Although he obtained a law degree from Yale University Law School, he decided not to pursue a legal career after failing the bar exam.

While studying at Yale, Robertson met his wife, Adelia “Dede” Elmer, in 1952. He was a Southern Baptist, and she was a Catholic pursuing a master’s in nursing. Against their families wishes, they eloped and were married by a justice of the peace.

According to Dede Robertson, her husband initially showed interest in politics until he experienced a religious transformation in 1957. He surprised her by disposing of their liquor collection, removing a nude print from the wall, and declaring that he had found the Lord.

Following what he believed to be divine guidance, they moved into a commune in New York City’s Bedford-Stuyvesant neighborhood, selling all their possessions to serve people experiencing poverty. Although tempted to return home to Ohio, Dede remained committed to their newfound mission.

Robertson received a master’s in divinity from New York Theological Seminary in 1959. He then traveled south with his family to purchase a bankrupt UHF television station in Portsmouth, Virginia. Despite having only $70 in his pocket, Robertson attracted investors, and CBN began broadcasting on October 1, 1961. As a tax-exempt religious nonprofit, CBN amassed millions in revenue, with $321 million in “ministry support” reported in 2022 alone.

One of Robertson’s innovations was using the talk-show format on the network’s flagship program, the “700 Club.” Originally a telethon where Robertson asked 700 viewers for monthly $10 contributions, the show resonated with audiences as it was better suited for television than traditional revival meetings or church services.

Green, the political science professor, described the “700 Club” as a platform where Robertson, an educated individual, engaged in sophisticated conversations with various guests on various topics. While the show had a religious undertone, it tackled everyday concerns.

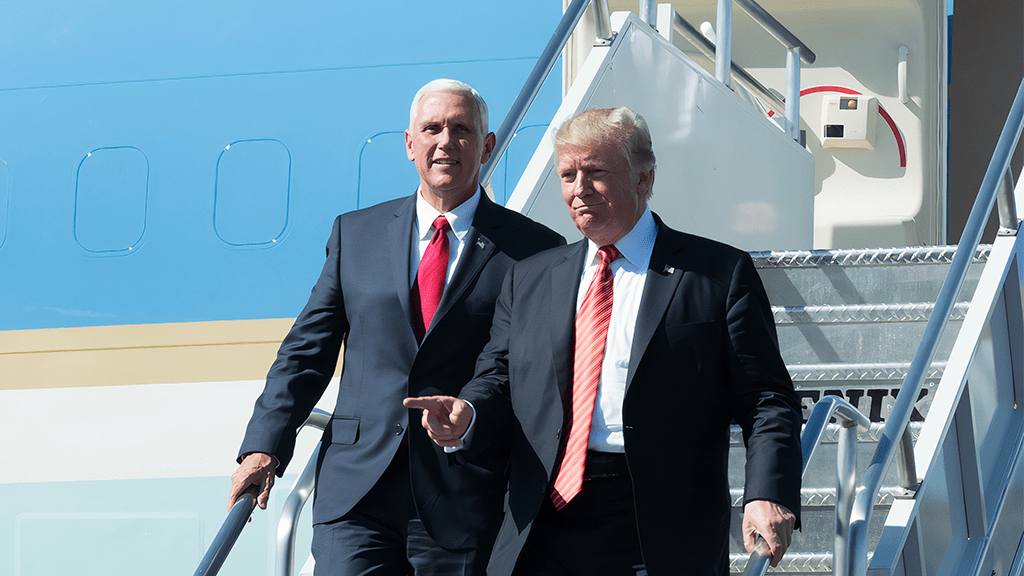

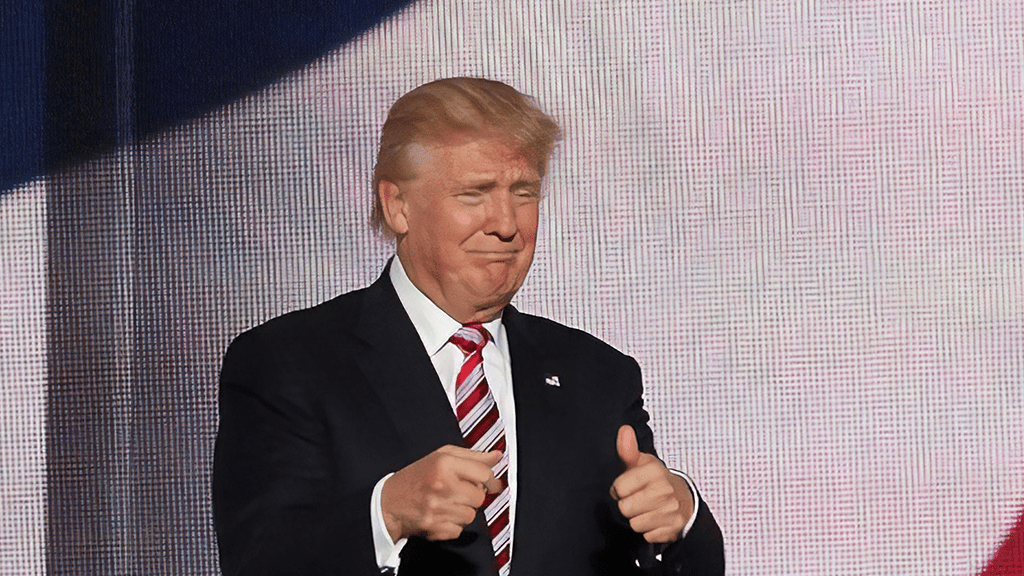

Over time, Robertson hosted several U.S. presidents on his show, including Jimmy Carter, Ronald Reagan, and Donald Trump.

However, Robertson also faced criticism for some of his on-air statements. For instance, he attributed the September 11, 2001, terrorist attacks to God’s anger over federal courts, pornography, abortion rights, and the separation of church and state. His comments about Islam as a violent religion during a show following the 9/11 attacks prompted President George W. Bush to distance himself and emphasize Islam’s peaceful nature.

In 2005, Robertson called for the assassination of Venezuelan President Hugo Chavez. That same year, he warned a rural Pennsylvania town that disaster might befall them after they voted out school board members who favored teaching “intelligent design” over evolution. In 1998, he suggested that Orlando, Florida, should be cautious of hurricanes because of the city’s annual Gay Days event.

Robertson also had moments of unpredictability. In 2010, he advocated for an end to mandatory prison sentences for marijuana possession convictions. Two years later, he stated on the “700 Club” that marijuana should be legalized and treated like alcohol, asserting that the government’s war on drugs had failed.

While he criticized Democrats involved in sex scandals, such as President Bill Clinton, Robertson helped solidify evangelical support for Donald Trump, downplaying the candidate’s sexually explicit remarks as an attempt to project a strong image.

After Trump’s inauguration, Robertson interviewed him at the White House, and CBN welcomed Trump advisors like Kellyanne Conway as guests.

However, following Trump’s defeat to Joe Biden in the 2020 election, Robertson stated that Trump was living in an “alternate reality” and urged him to move on.

Robertson’s son, Gordon, assumed the CEO of CBN in December 2007, while Robertson remained chairman and continued appearing on the “700 Club.” In 2021, after hosting the show for fifty years, Robertson stepped down, with his son taking over as the weekday host.

In addition to his broadcasting and educational endeavors, Robertson founded International Family Entertainment Inc., the parent company of The Family Channel, which was acquired by Rupert Murdoch’s News Corp. in 1997.

Read more: Pat Robertson, a prominent figure passed away at 93.

Evangelical and Christian political leader Pat Robertson passes away at age 93