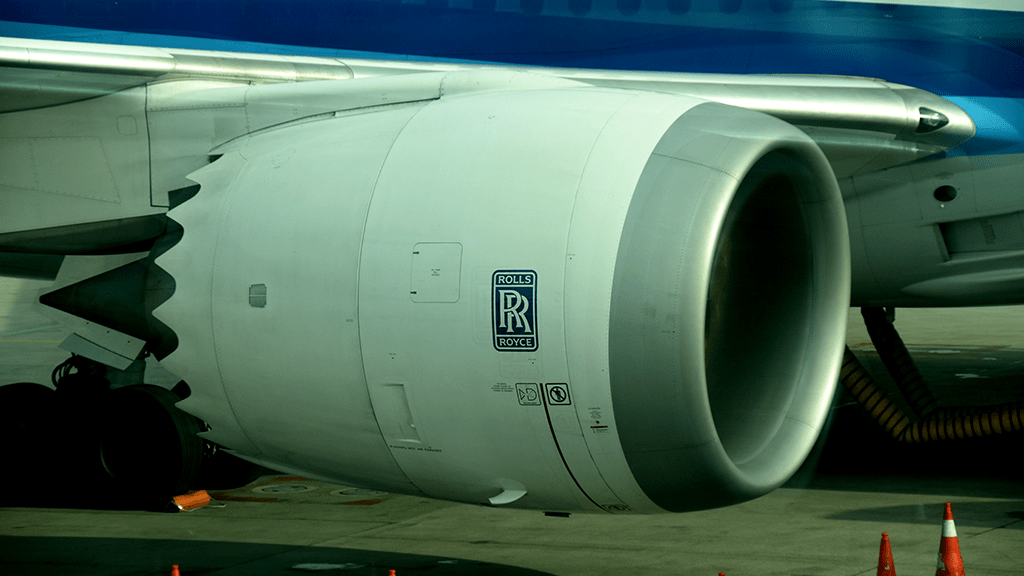

Outperforming Aerospace Stocks RollsRoyce (RYCEY)

June 8, 2023: RollsRoyce Holdings PLC (RYCEY), a company in the Aerospace group, has been outperforming its peers this year. Let’s dig into its year-to-date performance to understand why.

RYCEY is currently ranked #7 in the Zacks Sector Rank for Aerospace, which consists of 48 different companies. The Zacks Sector Rank considers and ranks various sector groups based on the average Zacks Rank of individual stocks within each group.

With a Zacks Rank of #2 (Buy), RYCEY displays positive characteristics that indicate it could beat the market over the next few months. Analyst sentiment has improved for RYCEY, as reflected by a 50% increase in the Zacks Consensus Estimate for its full-year earnings within the past quarter.

So far this year, RYCEY has provided a return of approximately 71%, while the average return for Aerospace stocks has declined by 5.9%. This demonstrates that RYCEY is outperforming its sector in terms of year-to-date returns.

Another Aerospace stock, TransDigm Group (TDG), has also been outperforming the sector this year, with a return of 26.1% since the beginning of the year. The consensus EPS estimate for TDG has increased by 3.4% for the current year and currently holds a Zacks Rank of #1 (Strong Buy).

To provide more context, RYCEY operates in the Aerospace – Defense Equipment industry, which consists of 22 companies and is ranked #91 in the Zacks Industry Rank. On average, stocks in this industry have experienced a 1.1% loss this year, further highlighting RYCEY’s superior year-to-date performance. TransDigm Group also belongs to this industry.

Investors interested in Aerospace stocks should closely monitor the performance of RYCEY and TransDigm Group, as both companies have shown strong performance and could continue to do so in the future.