Zimbabwe's Stock Market Skyrockets by 800% due to Desperate Savers

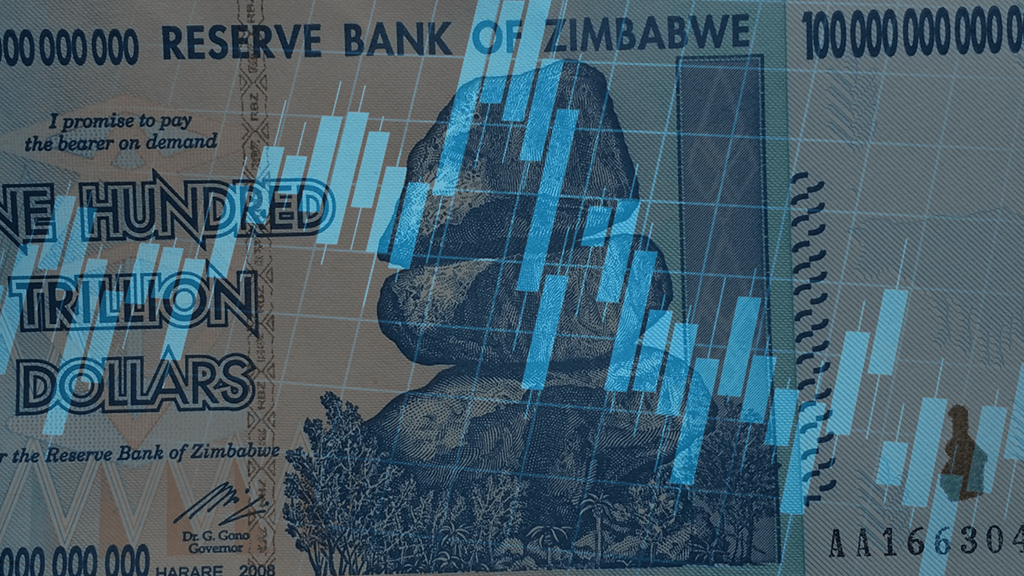

July 03, 2023: The stock market in Harare, Zimbabwe, has witnessed an unprecedented rally, with gains as high as 5%, 10%, and even 20% in just one trading session. If we tally up the year’s gains, it’s an astonishing 800% surge, making it the world’s biggest stock market rally, reported Bloomberg on July 3, 2023. However, this meteoric rise is not a reason for celebration but a cause for concern.

The driving force behind this furious rally is the fear of hyperinflation and its devastating impact on the value of people’s savings. Zimbabwe’s economy has a history of turmoil, with consumer prices increasing annually by over 100%. The scars of hyperinflation from the past run deep in the nation’s collective memory.

Desperate savers in the country are seeking a hedge to protect their money’s value, and the stock market is their chosen refuge. The local investors, faced with a devaluing Zimbabwe dollar that loses its value almost daily, see equities as a safer bet than holding cash. With inflation at an alarming 176% as of June, more and more people are pouring their savings into the stock market to escape the impact of rising prices.

Although the Zimbabwean stock market is relatively small, with a total capitalization of $1.8 billion and just 55 listed companies, it provides an accessible investment option for locals. Amid the economic uncertainty and currency instability, only some businesses are willing to accept the Zimbabwe dollar as payment for significant purchases like property, cars, or fuel. As a result, a significant portion of the currency finds its way into the equities market.

One of the investors benefiting from this stock market rally is Tatenda Nemaungwe, a former personal financial adviser who now manages his portfolio. His earnings have skyrocketed, earning more than ten times his old salary of $1,500 on average. He refers to the current situation as an “unending bull run.”

The popular stocks on the exchange are blue-chip companies like Delta Corp., Econet Wireless Zimbabwe Ltd., and EcoCash Holdings Zimbabwe Ltd. These companies are considered more stable as they provide essential products and services that Zimbabweans rely on, regardless of the economic challenges.

However, it’s not just local investors driving this rally. Foreigners have primarily abandoned the Zimbabwe equity market, accounting for only 15% of trading. The overall turnover is relatively low compared to major exchanges like Wall Street, with daily trading volumes around $650,000, while the Wall Street benchmark sees around $240 billion in combined dealings.

Zimbabwe’s stock market, established in 1894, is one of the oldest in Africa. Despite the turmoil in the country’s economy, the stock exchange stands in an upmarket Harare suburb known for its intelligent residences and well-maintained streets, contrasting the chaos in the capital’s downtown.

As the nation approaches elections, the stock market’s future remains uncertain. President Emmerson Mnangagwa is facing a fragmented opposition, and history has shown that election periods tend to make people hesitant about making critical financial decisions. After the elections, depending on the outcome, investors may continue their bullish approach or adapt to new circumstances after the elections.

In conclusion, Zimbabwe’s incredible 800% stock market rally is driven by investors seeking to protect their savings from rampant inflation. While this surge may seem promising, it comes amid economic challenges and uncertainty. As desperate savers flock to the stock market, only time will tell if this rally is sustainable or a temporary refuge from the currency crisis and inflation spiral.